Life Insurance in and around St Clair Shores

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

Can you guess the price of a typical funeral? Most people aren't aware that the mean cost of a funeral in this day and age is $8,500. That’s a heavy burden to carry when they are grieving a loss. If the people you love cannot pay for your burial or cremation, they may fall into debt following your passing. With a life insurance policy from State Farm, your family can live comfortably, even without your income. Whether it keeps paying for your home, pays off debts or maintains a current standard of living, the life insurance you choose can be there when it’s needed most by your loved ones.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Their Future Is Safe With State Farm

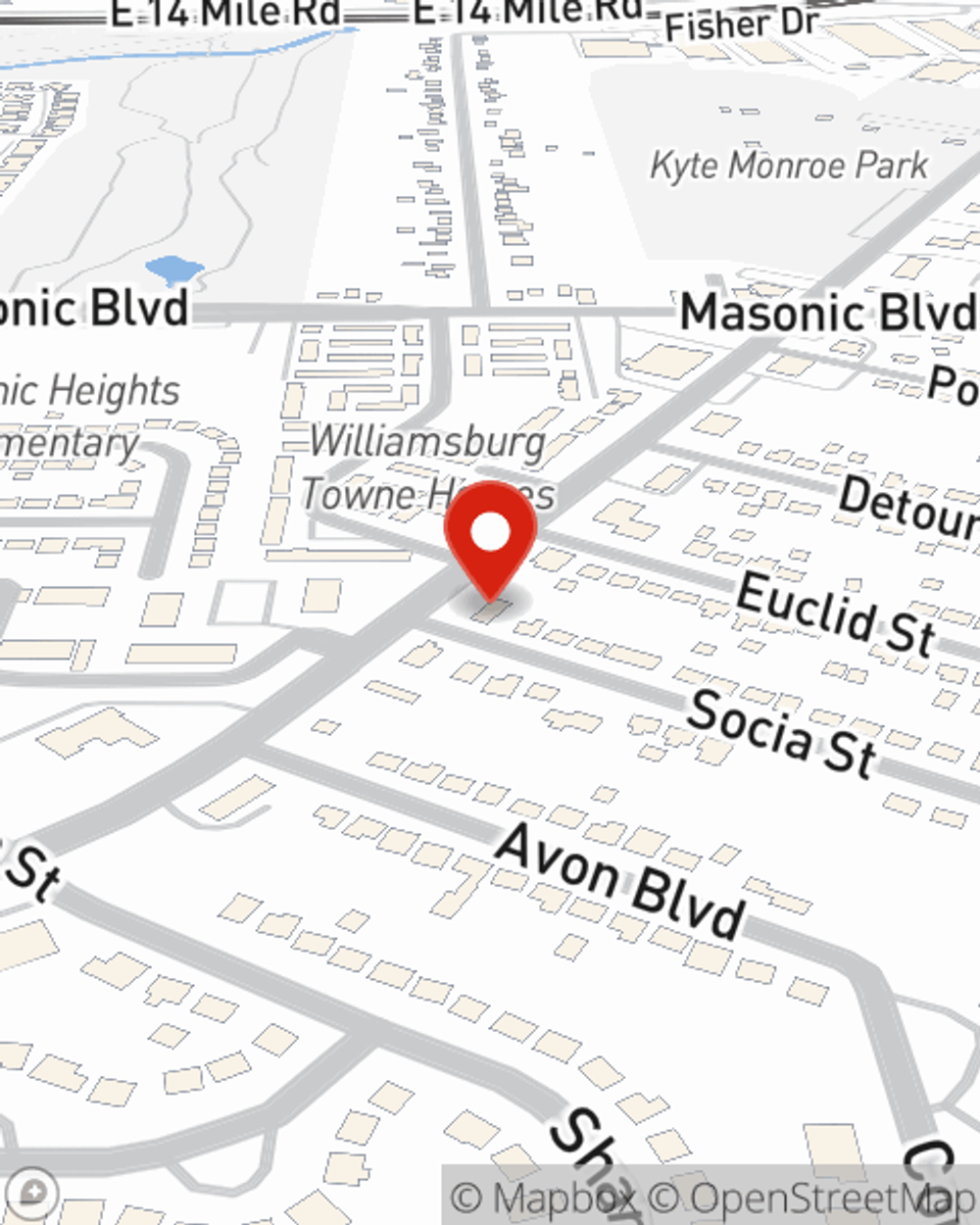

And State Farm Agent Sue Crowe is ready to help design a policy to meet you specific needs, whether you want coverage for a specific number of years or level or flexible payments with coverage designed to last a lifetime. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

State Farm offers a great option for anyone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can be of good use by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For more information, contact Sue Crowe, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Sue at (586) 296-3800 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Simple Insights®

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.